Adapting Cryptocurrencies – The Curves And Our Position On Them

- By Kriss

- Published on: May 11, 2021

You have probably heard of the “Diffusion of innovations” theory, widely popularized by Everett Rogers in the second half of the 20th century.

The Diffusion of innovations is a theory which basically tries to explain how, why, and at what rate new ideas and technologies are spread. It’s main popularizer Everett Rogers claims that diffusion is the process by which an innovation is communicated over time among the participants in a social system.

Rogers proposed that there are four main elements that influence the spread of a new idea: the innovation itself, communication channels, time, and the social system. As you can expect, this process relies heavily on human capital. So the innovation must be broadly adopted to self-sustain. At a certain rate of adoption, there should come a point at which an innovation reaches the critical mass.

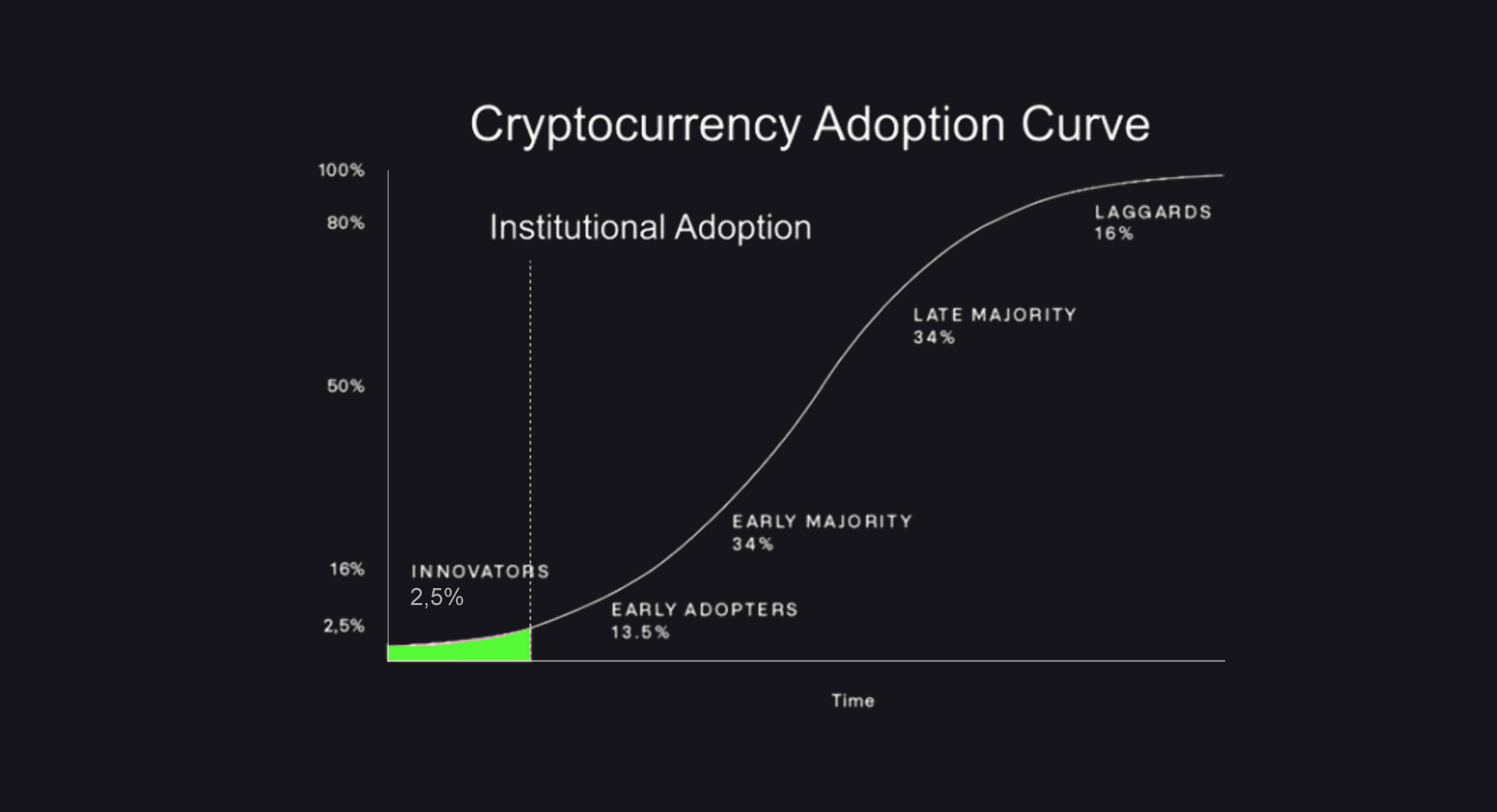

There are five categories of adopters: innovators, early adopters, early majority, late majority, and laggards.

- Innovators (2,5%) – individuals or companies who seek entirely new and risky adventures. They mostly tolerate quite large amounts of risk and uncertainty. They are usually not respected by the established social system.

- Early adopters (13.5%) – could be described as people who provide positive insights about new products and services, searching for improvements and efficiency. They’re usually seen as role models for larger masses, but at the same time not too far ahead of everyone else.

- The early majority (24%) – these are people who won’t try something until someone else has tried it first and confirmed it as useful and reliable.

- The late majority (24%) – the sceptical ones, for whom almost all the uncertainties of the innovation must be removed.

- Laggards (16%) – the last to adopt the innovation. Laggards mostly tend to be focused on “traditions”, have the lowest social status and also lowest financial liquidity. They’re usually the oldest amongst all adopters, and often in contact only with family and few close friends.

The adoption process of an innovation could be illustrated as a “bell curve” as seen below. But what has this all got to do with cryptocurrencies, you ask? Well, quite a lot.

In addition to the bell curve, Rogers claimed that innovation and new technologies such as Bitcoin, usually follow an S-curve in their adoption. The S-curve seen above shows the estimated adoption of Bitcoin.

As Bitcoin is the most well known crypto, we could take it as an example. Currently it is in the “Innovators” stage, also showing some signs of “Early Adopters”. This can be further explored by looking at the number of Bitcoin users and comparing this with the number of all it’s potential users.

The global internet user base is estimated to have reached 4,66 billion by January 2021. Of those 4,66 billion, about 100 million are also Bitcoin users. So it gives a Bitcoin adoption of about 2,15%, meaning the user base of 2,15% out of total potential, placing Bitcoin in the “Innovators” phase on the adoption curve.

Looking at the number of crypto users going through the ceiling in the last year, we could undoubtedly see crypto (especially Bitcoin) usage reaching the early adopters stage really soon.

- Share via

Kiara Sofia Smith

My current focus is blockchain technology and cryptocurrency. One could even call me a blockchain “enthusiast.” I have worked for almost a decade on several financial projects related to the stock market news, fundamental research and technical analysis for several blogs.

Recent Posts

Bitcoin Consumes More Energy Than a Lot of Countries. Why Is That Possible?

Why There Might Be a Correlation Between U.S. Covid Cases and Crypto Prices

About Us

We are friendly cryptocurrency community and our mission is to give the latest info access to the people.