Monetary system 2.0 – The Future World of Finance Is Built By Engineers Not Bankers!

- By Kriss

- Published on: July 20, 2021

Our future – a financial world built by engineers, not bankers

Are crypto and blockchain going to replace traditional systems of banking and finance? And could they pose a serious threat to central banks around the world? Well… yes. Cryptocurrencies are a significant threat to banks and according to our sources, most of the latter have taken an “if you can’t beat them, join them” mindset. Keep reading to find out more about the future of monetary systems.

If you asked us if decentralized finance could replace banking and traditional finance, the answer would be yes, of course. Cryptos could take over from fiat in all its uses as a store of value, medium of exchange and unit of account without hesitation. Decentralized blockchain-based systems could easily replace traditional banking with higher levels of security, faster transactions, lower fees and smart contracts. Decentralized finances allow us to already lend money or take out a loan, raise money for projects, and make payments. But this is just the beginning.

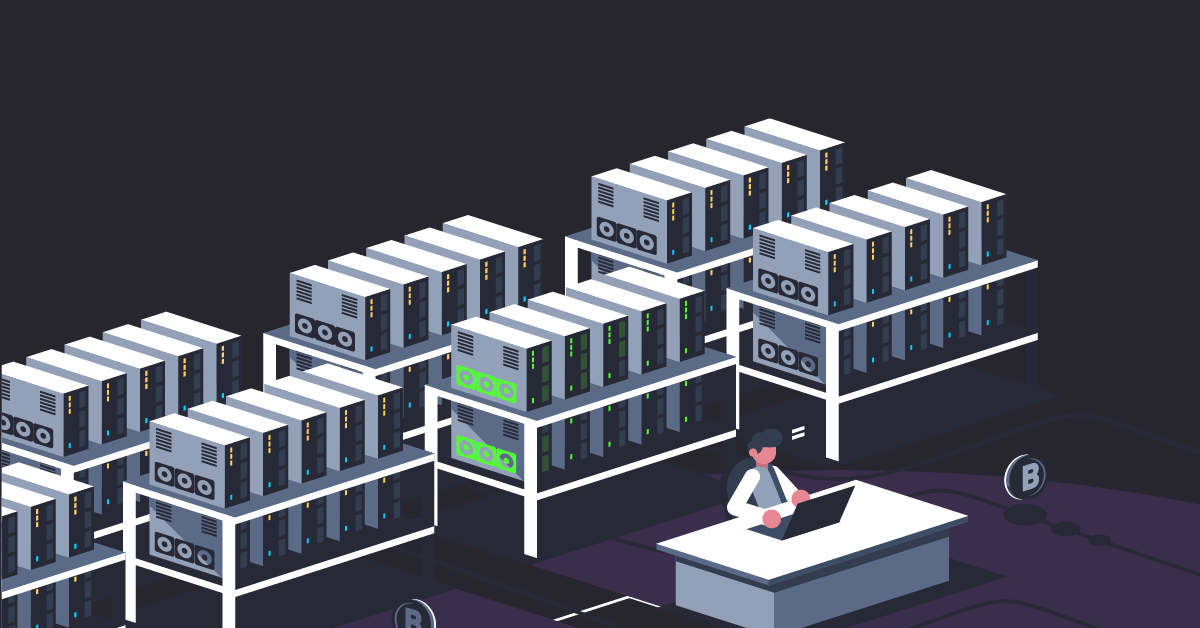

As a rare, beautiful metal that doesn’t corrode, gold took the role of money over many centuries because people agreed to give a certain value to it. Now, many investors are giving value on Bitcoin because, like gold, it is also rare – at this point there are about 18,7 million Bitcoins in circulation, and only a total of 21 million are available to be traded at all. What is more, Bitcoin is very secure – it can’t been hacked because of it’s secure blockchain technology, which requires the Bitcoin miners to use enormous amounts of computing power to verify their transactions, known as “proof of work.”

So, how does the “proof of work” work? Blockchains are made of blocks of data that are chained together as a computerized ledger of transactions. This ledger can’t be altered by anyone as each block has a timestamp which creates a permanent chronology of the inputted data. All users collectively hold control and only those with the necessary computing power can take part. Any meddling would be easily trackable, because every computer involved (these computers are called “nodes”) contains the whole history of all Bitcoin transactions, so if a user tries to modify a transaction, all the other nodes are able to cross-reference one another and discover the false information. Thus, blockchain constitutes a new form of shared value or money that is valuable because it cannot be breached or questioned. So Bitcoin actually could be looked at as a digital gold, in some ways.

But then again, Bitcoin is already an aging technology, regardless of the fact that it still is the biggest cryptocurrency to this day. Newer types of blockchain cryptocurrencies, for example Ethereum, are planning to cut down on the massive use of electricity by being based on “proof of stake” (how much money is invested) instead of “proof of work”. If Bitcoin can only be seen as a digital gold and store of value, Ethereum is also a blockchain-based platform for developers to create and manage apps that offer “smart contracts” for traditional financial products, like insurances or loans, without the need for agents like brokerages or banks. Ethereum and more “public blockchains” also offer nonfungible tokens (NFTs), that have already helped many artists, musicians, and even baseball card collectors to sell directly to the public without involving agents like banks, record labels, publishers, or lawyers.

A lot of people already believe that we could easily move from banking and finance to a more efficient and digital decentralized economy. But will it really happen? Banks and governments still have the most power in the world. It would be wide-eyed to think that they will just sit back and wait as crypto and blockchain replace them. Taxes need to be paid, and the governments need their cuts. As for now, nearly all world governments have at least considered releasing a digital version of their currency from their central bank – mainly to stop Bitcoin and other cryptos from gaining too much power.

In addition, central banks are trying to beat cryptocurrencies with a new ambitious concept called “stablecoins.” Stablecoins are digital currencies that are pretty much like cryptocurrencies, but instead of being fully decentralized like Bitcoin, they are completely backed with safe and liquid assets in the country’s domestic currency.

So the new reality seems to be that banks will be adopting blockchain systems in order to avoid the risk of becoming left out of the finance game. But instead of a free self-governing utopia, the future is taking shape to merge traditional financial institutions and banks with blockchain technology. However, many central banks are still confused as to what they can bring to the table. Ultimately, they are the exhaust opposite to the original argument of Bitcoin – providing a decentralized and private method of transacting.

In conclusion, traditional banks and financial services are going to need to adjust their ways to create more value to their users. The fact is that as our society becomes more informed on cryptos and blockchains, the more they see the advantages of them in the future of finance. More investors are becoming interested in crypto every day as there are so many resources available to find out more about blockchain technology implications. Banks and governments only need to adapt to it as well as possible.

- Share via

Kiara Sofia Smith

My current focus is blockchain technology and cryptocurrency. One could even call me a blockchain “enthusiast.” I have worked for almost a decade on several financial projects related to the stock market news, fundamental research and technical analysis for several blogs.

Recent Posts

Bitcoin Consumes More Energy Than a Lot of Countries. Why Is That Possible?

Why There Might Be a Correlation Between U.S. Covid Cases and Crypto Prices

About Us

We are friendly cryptocurrency community and our mission is to give the latest info access to the people.